Fixed Rate Home Equity Loans

Fixed Rate Option for your HELOC

Our UMB HELOC fixed rate loan option gives you the flexibility to accomplish your financial goals.

Offered to current HELOC clients, the option for converting your HELOC to a fixed rate loan provides the convenience of a line of credit with a locked-in interest rate.

Not yet a HELOC customer?

Learn more about UMB’s HELOC offering and how converting your HELOC to a fixed rate loan could help you with your next financial step.

How to use a fixed rate option HELOC

Converting your HELOC to a fixed rate HELOC loan can convert some or all of your UMB HELOC balance to a fixed rate for a set term. The fixed rate option may be a good choice if:

- You're concerned about a changing rate environment.

- You want fixed monthly payments.

- You want a strategy in place to help repay your balance over a set timeline.

Fixed rate HELOC benefits:

- Funds that allow you to accomplish your goals, whether it's fixing up the house or making a large purchase.

- Multiple payment options, including the option for interest-only payments during the draw period.

- Peace of mind to "lock in" up to three separate balances on your HELOC at a fixed rate. Options for interest-only or principal-and-interest payments.

Important details

The fixed rate HELOC option may be requested during the draw period. The interest rate and your monthly payment on any portion of your HELOC loan that converts to a fixed rate and the resulting monthly payment may be higher than your variable rate. When your fixed rate term ends, any unpaid balance reverts back to the current variable rate. Once you've locked a portion of your loan, you can still use the rest of your available credit at any time during the draw period. As you pay down the fixed rate HELOC balance, those funds become available again during the draw period.

The terms of your fixed rate HELOC advance will determine your monthly payment and whether you have an unpaid balance when the fixed rate term ends.

- Fixed rate balances can be either interest-only or principal-and-interest.

- Principal-and-interest payments are available for a maximum 20-year term and will repay your entire fixed-rate balance during the term.

- You may still make additional principal payments at any time, without penalty.*

Connect with us

Connect with your local UMB banker for additional details on converting your HELOC to a fixed rate loan.

Other Products and Services

View All*Maximum number of fixed rate conversions allowed per HELOC is three. Fixed rate conversions are not allowed for HELOCs which have previous or current past due payments. Fixed rate HELOC conversions may be requested during the draw period only.

Converting your HELOC to a fixed rate loan requires a minimum fixed rate balance of $5,000. Terms, rates and fees are subject to change, without notice, prior to closing your fixed rate option.

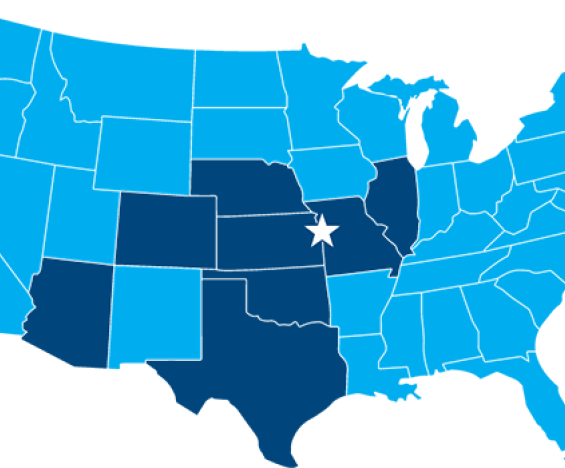

Restrictions and documentation requirements may apply. All loans subject to credit and collateral approval. Geographic restrictions apply.