UMB Checking Accounts

EARNS INTEREST

UMB Select Checking®

Apply Now$1,000 minimum opening deposit

Fee waivers and special loan rate discounts

Earn interest on your account balance

FEE WAIVER OPTIONS

UMB Value Checking®

Apply Now$100 minimum opening deposit

Monthly service fee waiver options

Unlimited deposits and withdrawals

NO MONTHLY SERVICE FEE

UMB Free Checking

Apply Now$10 minimum opening deposit

No monthly service fee

Paper statements included

CHECKLESS ACCOUNT

UMB Check-Free Banking

Apply Now$10 minimum opening deposit

No fee for four money orders each service-charge cycle

Visa® debit card included

Open a checking account online today

UMB has convenient checking accounts so you can focus less on your to-do list and more on your bucket list.

Online access

Quickly and easily manage your UMB checking account with Online Banking and the UMB Mobile Banking app.*

Exceptional service

UMB’s one-on-one financial coaching can help you get the most from your banking experience.

Banking built for you

Mobile banking, phone banking, bill pay, Apple Pay and more – bank however you want to bank with UMB.*

*Some restrictions may apply. See the UMB Online Banking Agreement and the UMB Mobile Remote Deposit Terms and Conditions for more information. Consult your mobile carrier about applicable data usage or SMS charges.

Compare

UMB SELECT CHECKING® ¹ |

UMB VALUE CHECKING® ¹ |

UMB FREE CHECKING ¹ |

UMB Check-Free Banking¹,² | |

|---|---|---|---|---|

| Is it right for you? | The perfect checking account to manage broader financial needs through preferred rates and discounts. | A checking account option with additional features to fuel financial growth. | A checking account to help you manage your everyday finances. | A paperless account without the worry of overdraft charges. |

| Minimum Opening Deposit | $1,000 | $100 | $10 | $10 |

| Check Features | No fee for Exclusive checks or 50% discount on non-Exclusive checks ordered through UMB’s preferred check vendor3 | 30% discount on non-Exclusive checks ordered through UMB’s preferred check vendor3 | Checks unavailable to order or be processed | |

| Monthly Service Fee | $20 | $8 | No fee | $5 |

| Monthly Service Fee Waiver Options |

SVG

|

SVG

|

||

| Ways to Waive Monthly Service Fee (Must satisfy one of these conditions each monthly service charge cycle) |

|

|

N/A | N/A |

| Cashier's Checks Included |

SVG

|

SVG

|

||

| Money Orders Included |

SVG

|

SVG

|

No fee for four money orders each service charge cycle | |

| Special Loan Rates and Loan Fee Discounts³ |

SVG

|

SVG

|

||

| Interest Paid on Balance |

SVG

|

|||

| Paper Statements | Included | Included | Included | $2 per month |

| Visa® Debit Card Included |

SVG

|

SVG

|

SVG

|

SVG

|

| UMB ATM Withdrawals | No fee | No fee | No fee | No fee |

| Non-UMB ATM Withdrawals⁴ | No UMB fee | 3 with no UMB fee; $2 each thereafter | $2 each | $2 each |

| Online Rates | View Rates | N/A | N/A | N/A |

| Application | Apply Now |

GET STARTED AND SEE YOUR SAVINGS GROW!

3.70% APY* 3-MONTH TIME DEPOSIT ACCOUNT

ON NEW ACCOUNT BALANCES OF $5,000 OR MORE

3.51% APY* 11-MONTH TIME DEPOSIT ACCOUNT

ON NEW ACCOUNT BALANCES OF $5,000 OR MORE

3.45% APY* 15-MONTH TIME DEPOSIT ACCOUNT

ON NEW ACCOUNT BALANCES OF $5,000 OR MORE

3.51% APY* UMB RETAIL MONEY MARKET ACCOUNT

ON NEW ACCOUNT BALANCES OF $10,000 OR MORE

*TERMS AND CONDITIONS APPLY

All Accounts Include

Online Banking Features

Online Bill Pay

With online banking, you can pay bills electronically from your UMB checking account to people and businesses across the U.S. Log in to your UMB online banking account to get started.

- One-time and recurring payments

- Schedule payments for a future date

- Review the due date and process time for payments

- Convenient and quick payee set up

- View payment history

Online Debit Card Management and Control

Choose how and where your checking debit card is used with self-service card management and card controls. Through UMB Online Banking and the UMB Mobile Banking app, you can:

- Restrict card use

- Set automated alerts

- Enable/disable cards

- And much more

Digital wallet

UMB's accounts work seamlessly with the latest digital wallet technology, including Google Pay, Apple Pay,

Samsung Pay,

and Garmin Pay.

Carry your credit card, debit card, gift cards and membership cards all within your device and pay with just a tap.

Direct Deposit

Direct deposit

With direct deposit, you can have the convenience and security of your funds being automatically deposited into your checking account without paper checks or extra trips to the ATM. To set up direct deposit, your employer or other income source will provide the necessary paperwork, and you will need your Social Security number and UMB's routing number - 101000695.

Overdraft Protection Services

Consumer Overdraft Protection Line of Credit*

Your activated Consumer Overdraft Protection Line of Credit operates similarly to a credit card, with a pre-authorized credit limit and an annual percentage rate. Consumer Overdraft Protection Line of Credit advances are for the exact amount that the account is overdrawn, bringing the account to a $0 available balance. Subject to credit approval.

*Please see service terms and conditions for more information about the Overdraft Protection service.

Credit Card Overdraft Protection*

UMB offers Credit Card Overdraft Protection for individuals who have been approved for a UMB credit card and wish to authorize funds to be made available in their checking account up to their available credit limit. Credit Card Overdraft Protection advances occur in $100 increments, up to available credit limit. If available credit limit is less than $100, the available amount will be advanced. Subject to credit approval.

*Please see service terms and conditions for more information about the Overdraft Protection service.

Account-to-Account Transfer Overdraft Protection*

UMB offers Account-to-Account Transfer Overdraft Protection for customers with multiple UMB deposit accounts. If your checking account becomes overdrawn, available balances in your designated savings or money market account will be used to cover the overdraft items.

*Please see service terms and conditions for more information about the Overdraft Protection service.

Looking for private banking solutions?

UMB offers personalized banking services for individuals and families with high net worth, including in-depth financial consultations and a full-service review of your goals and needs.

-

The benefits of using a debit card

Read NowHow a debit card works for you Debit card benefits Motley Fool Money ‡ reports that 90% of adults have a debit card. This is a very common type of card that is tied to your checking account at your...

-

FDIC insurance: Understanding how accounts are covered

Read NowWhat is the FDIC and how has it changed? The Federal Deposit Insurance Corporation (FDIC)‡ plays a crucial role in maintaining public confidence in the U.S. financial system. Established in 1933 as a response to the bank failures during the...

-

Which bank account is right for you?

Read NowThere are many different accounts where you can place your money, but what do they all mean and how can you use them to your advantage? Types of bank accounts Checking account Your checking account is a foundational piece of...

-

Not just for checks: Six ways to use your checking account

Read NowIf you’ve ever asked yourself, “What can checking accounts be used for,” we have news for you. Checking accounts have changed over the years and are no longer tied to physical checks like they were in the past. Despite their...

-

Benefits of having both checking and savings accounts (infographic)

Read NowMany individuals and families leverage bank accounts to help them manage their money. Some of the most common account types are checking and savings. Discover how having a checking account is essential to managing your money on a regular basis...

FAQs

Questions about your Checking Account? UMB has answers.

Finding the right checking account is all about the features you want. Look for features that make accessing your money easier, whether it’s online banking, ATM and branch locations, or special services like money orders and Cashier’s Checks.

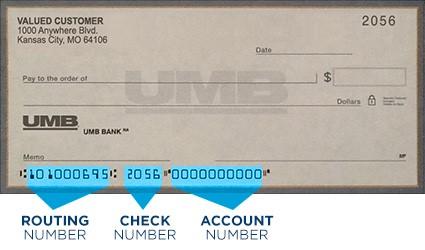

Your checking account number is at the bottom of a personal check. It’s usually the longest number (typically 10-12 digits) printed in a series of numbers.

Look at this example from a UMB personal checking account. Here, the UMB account number is third in the series at the bottom: bank routing number, check number, account number.

Usually, opening a checking account does not affect your credit score. A bank might look at your credit report when you apply to open a bank account. But this is typically a “soft inquiry,” which doesn’t impact your credit score.

If a bank uses a “hard inquiry” to review your credit report, the negative impact to your credit score is still relatively low.

Here are a few things you’ll need to open a personal checking account:

- A state-issued ID, driver’s license or learner’s permit. If you do not have these forms of identification, please contact a nearby UMB branch for more information about forms of identification accepted in branch.

- Basic personal information, including your birthdate, Social Security Number (SSN) or Tax ID Number (TIN), address and phone number.

- An initial deposit may be required to open the account. Banks usually offer a variety of checking account options with different requirements for initial deposits.

In some situations, you might also need:

- IDs and personal information for other applicants if you want to open a joint account. A joint account is owned by multiple people, so a bank requires information from anyone sharing the account.

- A co-owner or co-signer if you are younger than 18. A parent or legal guardian will need to sign legal documents for the bank.

Yes, you can open a checking account online. Most banks provide a simple and secure online bank account application process. To open a UMB account online, you must:

- Be at least 18 years old.

- Be a U.S. citizen or resident alien.

- Live in Arizona, California, Colorado, Illinois, Iowa, Kansas, Minnesota, Missouri, Nebraska, New Mexico, Oklahoma, Texas, Utah and Wisconsin.

- Have a state ID, driver’s license or learner’s permit.

You can get started with UMB today. It takes just a few minutes to apply for and open a UMB personal checking account.

Checking your account balance regularly is a great way to track your spending habits and financial goals. Here’s how to check your UMB account balance:

- Download the UMB mobile banking app for on-the-go account access.

- Visit umb.com/onlinebanking. To register for online banking, you’ll need your account number and personal information.

- Call 800.860.4UMB (4862) to hear your account balance or speak to a representative at the UMB Service Center. You’ll need to activate your direct banking access the first time you call.

- Stop by the nearest UMB branch or ATM. Have your ID with you, and a UMB personal banker will be happy to help you at a branch. You can also check account balances using your UMB card and PIN at an ATM.

- Enroll in paperless statements through UMB Online Banking to have account statements conveniently emailed to you.

Yes, certain checking accounts can earn interest. Interest-bearing checking accounts usually require a higher minimum opening deposit. Banks often offer fee waivers if you make larger initial deposits or maintain higher balances.

If you’d like to earn interest on your account at UMB, consider opening a UMB Select Checking account. This account type also offers access to special loan rate discounts.

If an interest-bearing checking account isn’t right for you, we also offer UMB Value Checking and UMB Free Checking. Find the best fit for you by comparing UMB personal checking account options.

To reorder checks for your UMB account, you can:

- Order through online banking. Log in to your account to access the order dashboard.

- Order online through Deluxe Financial Services, Inc.

- Order at a branch or connect with us to get started (best for first-time check orders or information changes)

Download or view the UMB Consumer Banking Schedule of Service Fees and Charges

Download or view your deposit account agreement.

Download or view UMB's Funds Transfer and Payment Order (Wire) Authorization Terms and Conditions

Download or view the An Easy Way to Balance Your Check Book form.

Other Products and Services

View All- Should the checking account be closed or transferred to a nonqualifying product, standard fees will apply.

- Check writing capabilities and online bill payment are not available for UMB Check-Free Banking.

- Shipping charges may apply.

- Subject to credit and collateral approval. Restrictions apply.

- The institution that owns the non-UMB Bank ATM may also charge an access fee.

Review checking account details in our comparison table. If you need assistance, have a UMB banker contact you.

To open an account online, you must:

- be 18 years old or older

- be a U.S. citizen or U.S. resident alien

- live in one of the following states: Arizona, California, Colorado, Illinois, Iowa, Kansas, Minnesota, Missouri, Nebraska, New Mexico, Oklahoma, Texas, Utah and Wisconsin

- have a state ID, driver’s license, or learner’s permit. If you do not have these forms of identification, please contact a nearby branch for more information about forms of identification accepted in branch.