Alerts and Updates

Your resource for the latest information on privacy and security

Privacy and security are an essential part of UMB’s commitment to its customers, and a foundational aspect of how we deliver safe, secure and quality products and services. This page updates periodically and contains important information on privacy and security topics and trends.

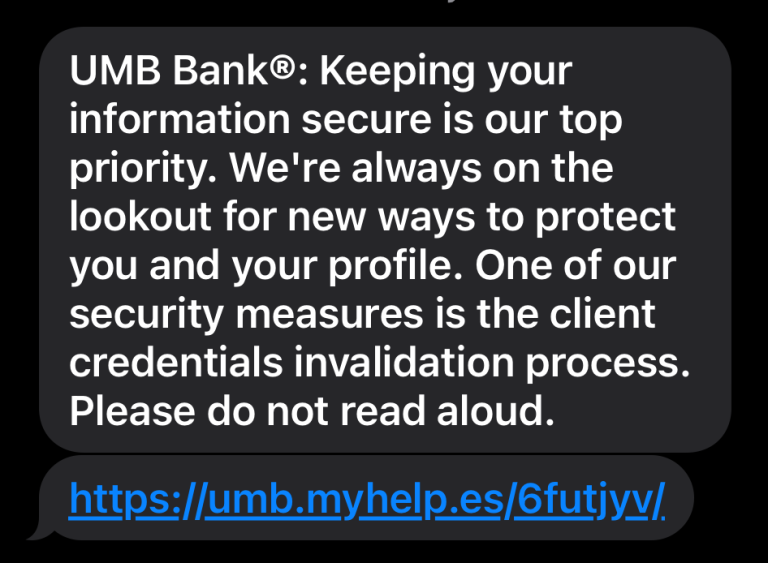

Be Alert: Bank Impersonation Scams

Bank impersonation scams are rampant nationwide. These scams involve mailed letters, text messages or calls that appear to come from your bank, but they really come from a fraudster trying to get your personal information and access your accounts. Click Read More below to learn more.

Be Alert: Spoofing Scams Impersonating UMB – Career Recruitment

In recruitment and hiring scams, fraudulent job offers may be extended by individuals impersonating members of our Talent Acquisition team. These scams may include fake interviews, offer letters, and requests for personal or financial information. Click Read More below to learn more.

Be Alert: Spoofing Scams Impersonating UMB – HTLF Acquisition

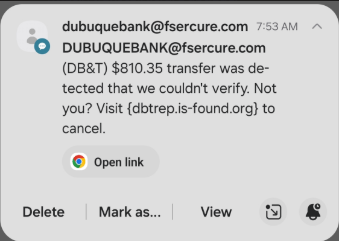

Financial institutions are seeing a heightened number of spoofing scams, including being impersonated by fraudsters via text message to convince recipients they are interacting with a trusted party. Click Read More below for an example and to learn more.

The content provided in this message is intended for educational purposes only, and UMB does not make any representation and shall not be liable for any of the contents of this message.

Business email compromise: How to identify red flags and reduce risk

Business email compromise (BEC) scams are a type of online payment fraud that target businesses and can result in significant financial loss. BEC involves gaining unauthorized access to a legitimate email, text message, or social media account or an attempt to spoof or fake a legitimate account.